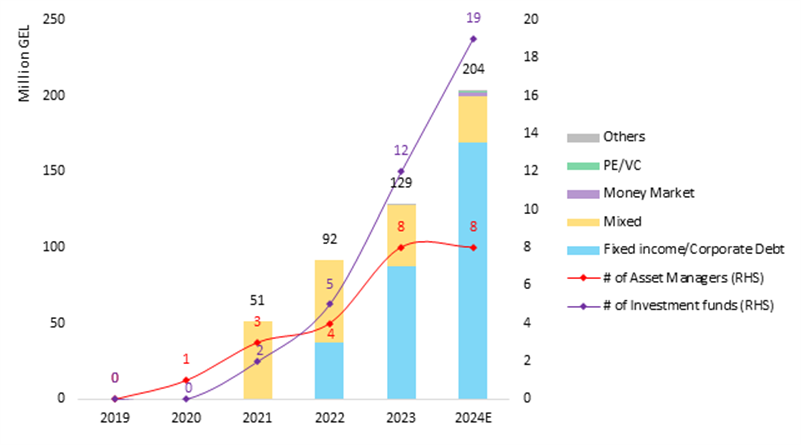

Assets of Investment Funds in Georgia Exceed GEL 200 Million

The Georgian investment fund market has experienced dynamic growth in recent years. The first asset management company was registered in 2020, followed by the establishment of the first investment fund in 2021. Over the next three years, the total assets under management grew at an average annual rate of 59%, surpassing GEL 200 million by the end of 2024. During this period, the number of asset management companies and investment funds also increased significantly. As of December 31, 2024, the market comprised eight asset management companies and 19 investment funds.

The investment fund sector in Georgia is characterized by a diverse range of strategies, including investments in debt and fixed-income instruments, private and venture capital, and mixed funds, among others.

One of the key drivers behind this growth has been the National Bank of Georgia’s commitment to fostering the sustainable development of the financial sector and enhancing the regulatory framework. Legislative initiatives and capital market development measures introduced by the NBG in recent years have contributed to creating a more diverse and inclusive investment environment, making it easier for new participants to enter the market.

A significant milestone in this process was the adoption of the Law on Investment Funds in July 2020, which was followed by the modernization and strengthening of the regulatory framework. Aligned with EU directives and the core principles of the International Organization of Securities Commissions (IOSCO), the new law has been recognized in an analytical report published by the European Commission in February 2023, confirming its compliance with EU legislation. This well-established regulatory foundation has increased market participants' interest in investment funds and asset management companies in Georgia.

Ultimately, the robust regulatory framework and supervision by the National Bank of Georgia continue to support market growth, attracting new investors. In the long term, these developments are expected to have a positive impact on financial stability and the country’s economic development.