Fitch Ratings: Russia Flight Ban to Weigh on Georgian Growth, Current Account

Russia's ban on flights to and from Georgia is likely to weigh on Georgian economic growth and could hamper the reduction of the sovereign's external vulnerabilities, Fitch Ratings says.

Russia will suspend flights to and from Georgia from 8 July. The move came after an address to Georgian MPs by a Russian lawmaker inflamed long-standing bilateral tensions, leading to large demonstrations in Tbilisi and criticism from Georgian politicians, who accused Russia of interfering in Georgia's internal affairs.

The flight suspension will chiefly affect Georgia's economic growth and external finances through its impact on tourism. Tourism has grown in recent years, contributing about 7.5% of GDP and 70% of service exports in 2018. It has contributed significantly to the narrowing of the country's structurally large current account deficit. A reduction in tourism earnings from Russia (which more than tripled to 4.9% of GDP between 2014 and 2018) could therefore hinder this improvement.

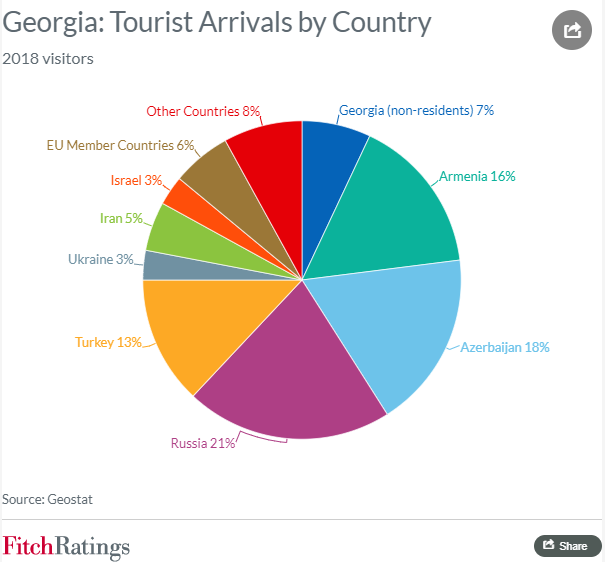

Russian tourists accounted for 20.9% of total tourist arrivals last year. Russian visitors mostly arrive by road, and a decline in Russian arrivals could be partly offset by an increase in visitors from other countries (about one third of tourist arrivals last year were from Azerbaijan and Armenia). Russia is not a major source of FDI, accounting for 5% of total FDI last year. Nevertheless, lower tourism inflows coupled with possible lower FDI present a risk to our GDP growth forecasts, currently 4.6% this year and 4.7% in 2020.

Another driver of the upgrade was the Georgian economy's resilience to external shocks last year including Turkey's currency crisis, reflecting a diversification of sources of current account inflows, rising tourism revenues and remittances (notably from the EU), and prudent fiscal and monetary policy settings.

The IMF's fourth review under its three-year Extended Fund Facility, completed last month, highlighted Georgia's strong record of economic reform. We think the central bank will continue its policy of reserve accumulation and we currently forecast reserves to rise to USD3.4 billion this year and USD3.5 billion (three months of current external payments next year, from USD3.3 billion at end-2018). The IMF programme also provides additional external liquidity buffers.

Opposition-led protests against the government's handling of the initial anti-Russian demonstrations have led to the resignation of the Interior Minister, and the government has conceded to demands to adopt proportional representational for parliamentary elections scheduled in 2020 (the change was previously planned for 2024). It remains to be seen whether this will bolster popular support for the ruling Georgian Dream-Democratic Georgia-led coalition.