Vienna Insurance Group Reports Top Results After first three Quarters of 2021

Net profit up by approx. 54% and earnings per share increase to EUR 2.86.

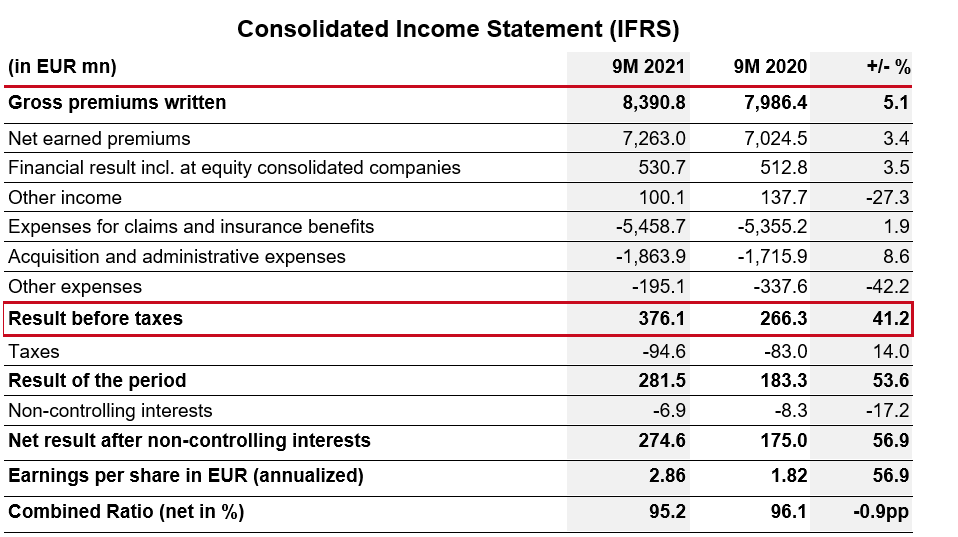

- Premium volume increases 5.1% to EUR 8.4 billion

- Profit before taxes rises 41.2% to EUR 376 million

- Combined ratio improves 0.9 percentage points to 95.2%

Vienna Insurance Group has reported a significant improvement in all key figures for the first to third quarter of 2021 compared to the same period in the previous year. The results also exceed the figures achieved in 2019, before the pandemic. VIG Group has thus delivered a consistently positive performance since the start of the year.

"We are unfortunately still experiencing a global pandemic that continues to have a significant impact on social and economic life in our markets. We were able to successfully manage the trends in the insurance business thanks to our diversified positioning and by taking prompt actions locally. VIG Group continues to offer security and stability even under difficult circumstances. The economy has also performed better in our region Central and Eastern Europe (CEE) than initially forecast some months ago. We are therefore very confident that we will achieve our targets for 2021 and exceed the projected premium volume of EUR 10.4 billion", says CEO Elisabeth Stadler, highlighting the positive interim results.

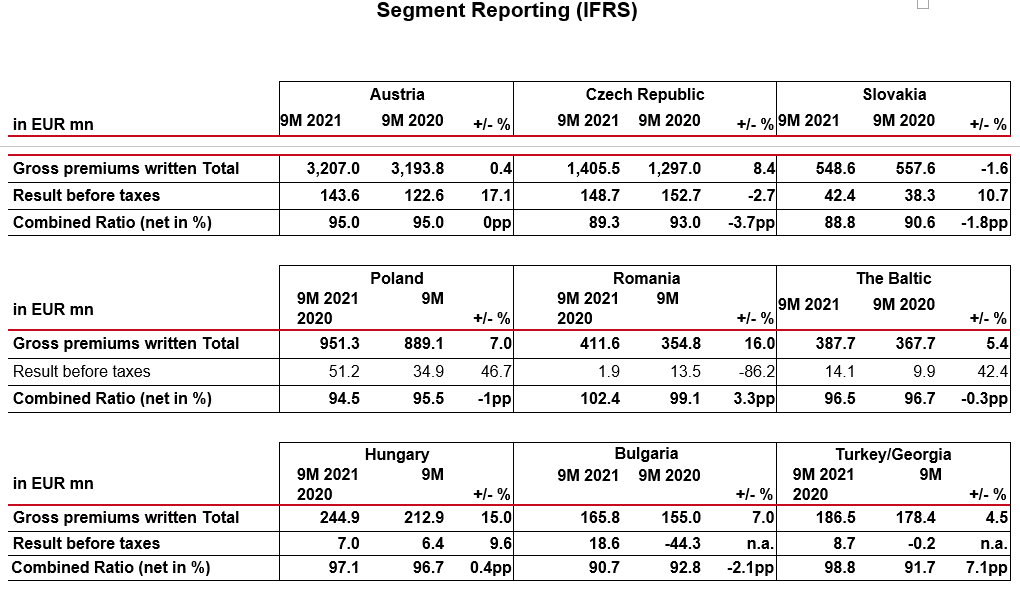

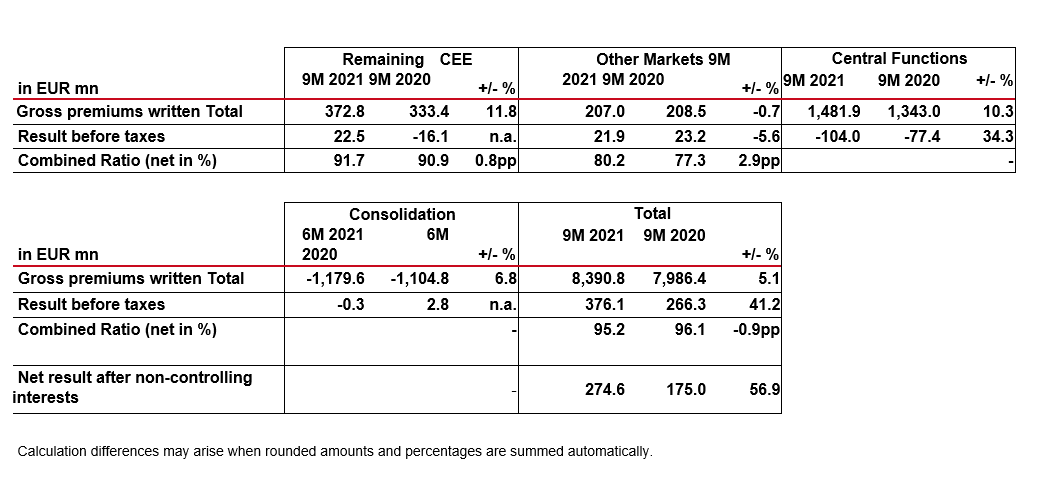

Premiums increase to EUR 8,391 million

The premium volume is up by 5.1% to EUR 8,391 million. As was also the case in previous quarters, all lines of business, with the exception of single-premium life insurance, are posting significant growth. Other property and casualty made particularly strong progress, increasing by 7.4% to EUR 4.1 billion. Corporate business, reporting premium growth of 13% to EUR 1.1 billion, is responsible for a sizeable proportion of this favourable performance. Under difficult market conditions, we have successfully harnessed our expertise and our customer focus to expand our market leadership in Austria and our position as the largest industrial insurer in CEE. Regular-premium life insurance is up by 2.8% to EUR 2 billion euro; motor third-party liability increased by 4.9% to EUR 1.2 billion; and motor own damage is up by a pleasing 8.6% to EUR 1.1 billion. The pandemic has raised health awareness and the willingness to make provisions. This is reflected positively in the EUR 545.2 million health insurance premium volume, which represents a 4.5% increase. According to plan, single-premium life insurance is down again, by 2.9% to EUR 661.7 million. The largest premium increases were achieved in the segments Czech Republic, Poland and Romania.

Result before taxes of EUR 376.1 million

At EUR 376.1 million, the profit before taxes was up significantly compared to the same period of the previous year, by around 41.2%. The result after taxes and non-controlling interests has also increased significantly (+56.9%). As of 30 September 2021, it was EUR 274.6 million.

VIENNA INSURANCE GROUP AG Wiener Versicherung Gruppe, Schottenring 30, 1010 Vienna, registered with the Commercial Court of Vienna under FN 75687 f, VAT No.: ATU 36837900

Other key financial figures

The financial result (including the result from at-equity consolidated companies) was also up by 3.5% at EUR 530.7 million. The return on equity before taxes improved from 8.1% to 10.8%. Investments, including cash and cash equivalents, amounted to EUR 37.5 billion as of 30 September 2021.

Earnings per share (annualised) rose from EUR 1.82 to EUR 2.86 in the period under review (+56.9%).

Combined ratio 95.2%

The VIG Group combined ratio of 95.2% was 0.9 percentage points better than the previous year. The impact of weather-related claims this year has been offset by the comprehensive reinsurance programme and the positive effects of the strategic measures taken as part of Agenda 2020.

Outlook for 2021

For the CEE region, the Vienna Institute for International Economic Studies (wiiw) expects economic growth of 5.4% in 2021, which is significantly higher than the figure of 4.8% for the eurozone. This indicates that the CEE region is recovering more quickly than expected over the course of 2021. In terms of economic growth, this region has now on average returned to pre-crisis levels. On this basis, VIG Group anticipates that the targets set for 2021 will be met, with the expected premium volume of around EUR 10.4 billion likely to be slightly exceeded. Expected profit before taxes is confirmed at between EUR 450 million and EUR 500 million. The combined ratio is expected to remain at around 95%.

Calculation differences may arise when rounded amounts and percentages are summed automatically.